It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. For small businesses, mastering this aspect of financial analysis is a step towards sustained growth and success. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit.

How confident are you in your long term financial plan?

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. For example, in sectors with high fixed costs, such as those with hefty capital investments or sizable research and development expenditures, a higher contribution margin ratio may be needed to achieve viability. Understanding the contribution margin of your products or services can guide critical decisions such as pricing, product mix, and cost management.

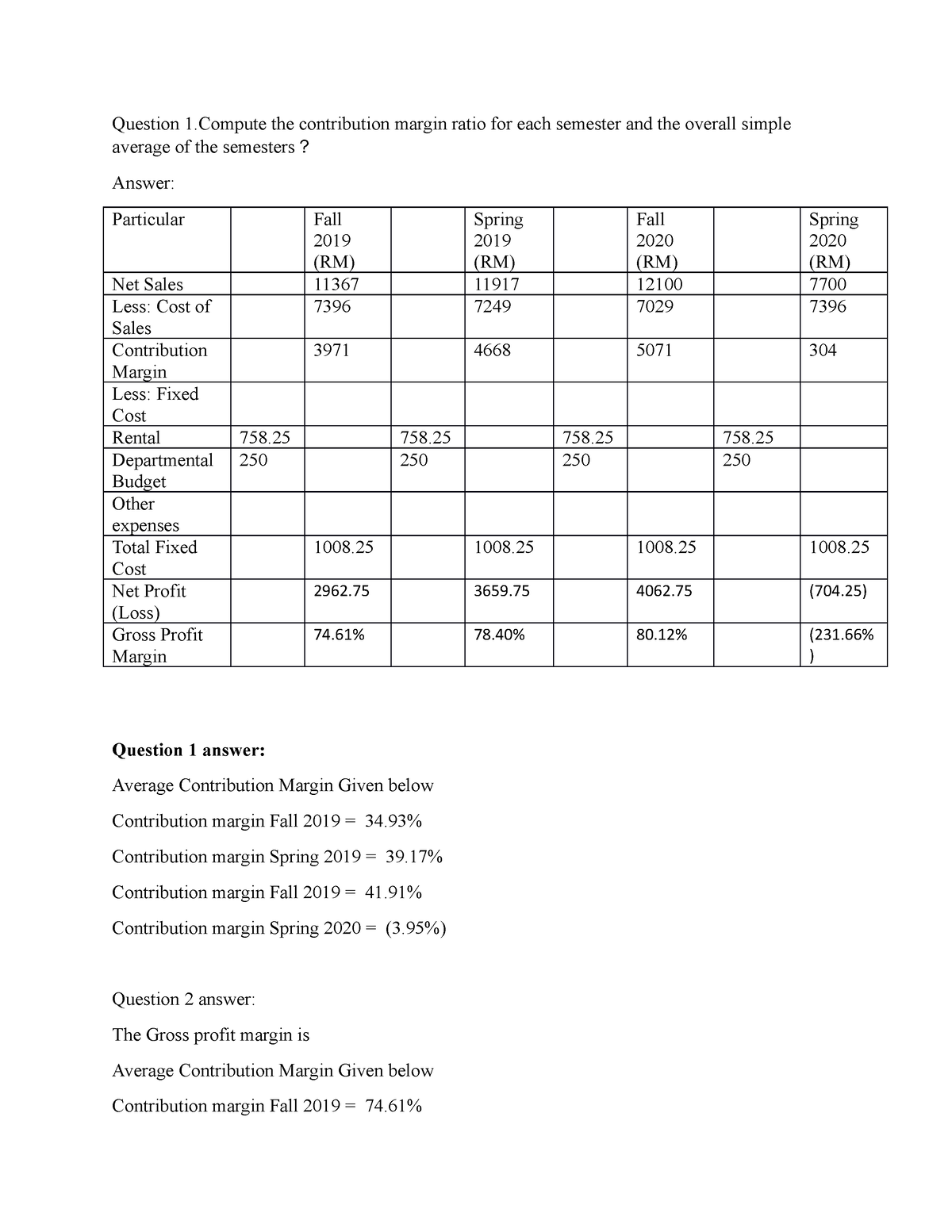

How to Calculate the Contribution Margin Ratio

- Additionally, understanding the financial ratios that emerge from this analysis can guide strategic decisions.

- The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure).

- Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin.

- This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.

- Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers.

- Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency.

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. The formula to calculate the contribution margin is equal to revenue minus variable costs. Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales.

Do you already work with a financial advisor?

Only two more steps remain in our quick exercise, starting with the calculation of the contribution margin per unit – the difference between the selling price per unit and variable cost per unit – which equals $30.00. It means there’s more money for covering fixed costs and contributing to profit. You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. You need to calculate the contribution margin to understand whether your business can cover its fixed cost.

The $30.00 represents the earnings remaining after deducting variable costs (and is left over to cover fixed costs and more). The resulting ratio compares the contribution margin per unit to the selling price of each unit to understand the specific costs of a particular product. Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500. Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows.

However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). Thus, to arrive at the net sales of your business, you need to use the following formula. The actual calculation of contribution margin may be more laborious but the concept applies. Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers.

This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. Contribution margin focuses on the revenue left after covering variable costs, while what is an accrued expense square business glossary gross profit subtracts both variable and fixed costs. The contribution margin helps in analyzing the impact of variable costs and pricing, while gross profit provides a broader view of overall profitability.

The product revenue and number of products sold can be divided to determine the selling price per unit, which is $50.00 per product. In 2022, the product generated $1 billion in revenue, with 20 million units sold, alongside $400 million in variable costs. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit. To cover the company’s fixed cost, this portion of the revenue is available. After all fixed costs have been covered, this provides an operating profit. Now, this situation can change when your level of production increases.

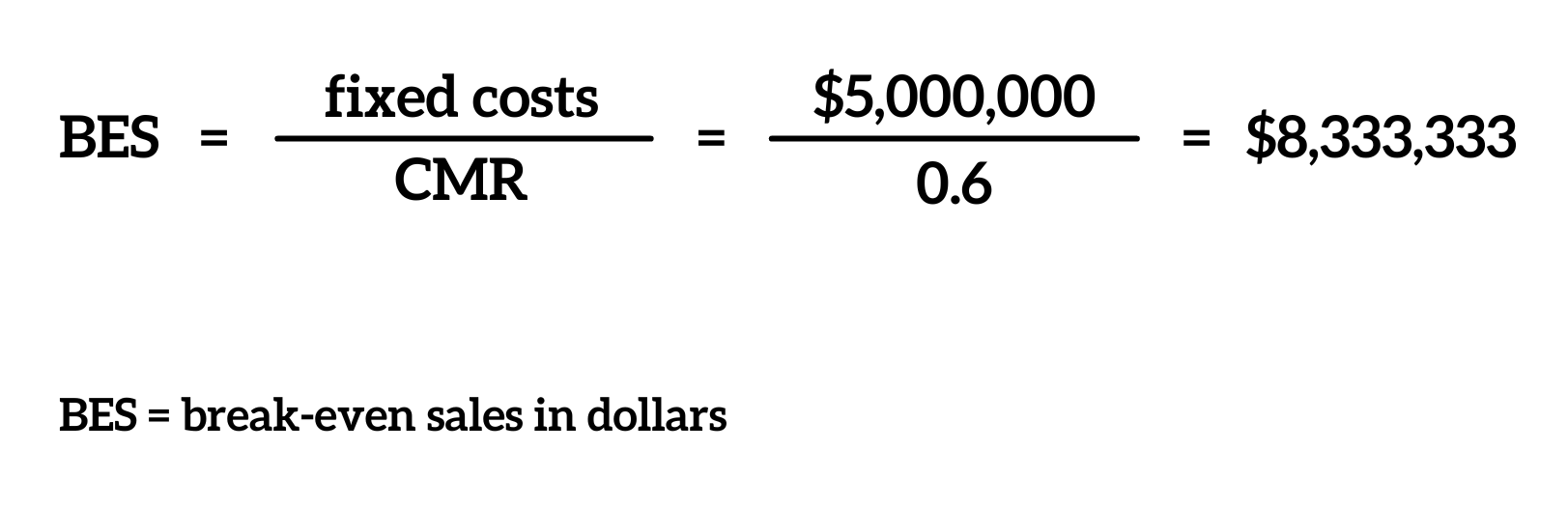

Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio. To get the ratio, all you need to do is divide the contribution margin by the total revenue. The contribution margin (CM) is the amount of revenue in excess of variable costs. This is because the breakeven point indicates whether your company can cover its fixed cost without any additional funding from outside financiers. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs.

The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. It is essential to understand contribution margins in healthcare because. It gives you an estimate of how much it will cost to run the practice or hospital.

Commenti recenti