To calculate the value of common stock, multiply the number of shares the company issues by the par value per share. When a shareholder donates shares back to the corporation without compensation, these shares are recorded as treasury stock at fair market value (FMV) on the date of donation. This transaction doesn’t affect total stockholders’ equity since it simply reallocates value between Treasury Stock and APIC.

FAR CPA Practice Questions: Debt Covenant Compliance Calculations

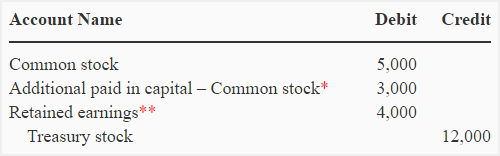

Treasury stock is not considered an asset; it is a reduction in stockholders’ equity. Any difference between the repurchase cost and the par value is adjusted through Additional Paid-In Capital (APIC), and if APIC is insufficient, Retained Earnings is used to absorb the remaining amount. The difference between the number of shares assumed to have been issued related to the dilutive securities and the number of shares repurchased as part of TSM is the net dilutive impact. For a long time, it was considered standard to include only the number of options and dilutive securities that are exercisable in the calculation of diluted shares, as opposed to outstanding. The simplest way for companies is to reacquire any outstanding shares of the company directly from the market.

- In the last part of the formula, the number of shares repurchased is deducted from the total potential shares issued to calculate the net dilution, which is completed for each of the three option tranches.

- Treasury stock, also known as reacquired stock, represents shares of the company that have been reacquired from the market.

- It is common for stocks to have a minimum par value, such as $1, but sell and be repurchased for much more.

- Treasury stock transactions have no effect on the number of shares authorized or issued.

What is a treasury stock method?

The par value method is an alternative way to value the stock acquired in a buyback. Under this method, shares are valued according to their par value at the time of repurchase. This sum is debited from the treasury stock account, to decrease total shareholders’ equity. The common stock APIC account is also debited by the amount originally paid in excess of par value by the shareholders. The net amount is recorded as either a debit or a credit, depending on whether the company paid more or less than the shareholders did originally.

If treasury shares are not resold, what effect would this have on assets and retained earnings?

If the treasury stock is resold later, the cash account is increased through a debit while the treasury stock account is decreased. This increases total shareholders’ equity through a credit notation top 5 tax breaks for parents getting a degree on the balance sheet. Treasury stock at cost method is an accounting approach by which the actual price paid for treasury shares are debited to APIC and credited to treasury stock at cost.

Any person can buy or sell their shares on the stock market without their transaction having any affect on the company or its activities. To calculate the fully diluted number of shares outstanding, the standard approach is the treasury stock method (TSM). Contra-equity accounts have a debit balance and reduce the total amount of equity owned – i.e. an increase in treasury stock causes the shareholders’ equity value to decline.

Diluted EPS Calculation Example

The formula for calculating the net dilution from each tranche of options contains an “IF” function that first confirms that the strike price is less than the current share price. If we were to ignore the dilutive impact of non-basic shares in the calculation of equity value, we would arrive at $200mm. Suppose a company has 100,000 common shares outstanding and $200,000 in net income in the last twelve months (LTM). To record a repurchase, simply record the entire amount of the purchase in the treasury stock account. In financial markets, the term ‘Treasury Stock’ holds significant weight, impacting a company’s financial standing and influencing shareholder value.

This loss does not affect the current period’s income but reduces the credit balance in the paid-in capital account that resulted from other treasury stock transactions. If treasury stock method is used, any purchase of treasury shares results in a credit to APIC and a debit to treasury stock at cost. A company might purchase its own outstanding stock for a number of possible reasons.

When treasury stock is resold above its cost, Cash is debited for the entire proceeds. A corporation’s board of directors may decide to acquire treasury shares for various reasons. One reason for this action is to obtain shares for re-issuance when all authorized shares are issued and outstanding. Because shares of stocks will frequently have a par value near zero, the market value is nearly always higher than par. Rather than looking to purchase shares below par value, investors make money on the changing value of a stock over time based on company performance and investor sentiment. The amount of additional capital contributed by the shareowners in excess of the par or stated value of the shares is recorded in an account called APIC.

Under the par value method, at the time of share repurchase, the treasury stock account is debited, to decrease total shareholder’s equity, in the amount of the par value of the shares being repurchased. It is common for stocks to have a minimum par value, such as $1, but sell and be repurchased for much more. Consider a company that reports 100,000 basic shares outstanding, $500,000 in net income for the past year, and 10,000 in-the-money options and warrants, with an average exercise price of $50.

Commenti recenti